carbon tax benefits and disadvantages

Solar panels have a long life expectancy and are easily recyclable. Advantages and Disadvantages of Carbon Tax and Environment Compensation Charge.

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

The Pros of Carbon Offsetting.

. The only carbon tax with teeth would be one with global reach which is a nonstarter. Higher incentive for people to avoid the use of fossil fuels. This can be done by placing a surcharge on carbon-based fuels and other sources of pollution such as industrial processes.

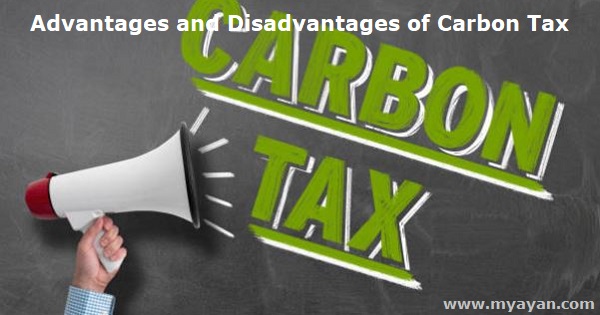

Carbon tax as a reflection of societys willingness to pay to reduce the risk of potentially very expensive damage in the future. While the price of fuels are subject to market forces and fluctuate accordingly the size of the carbon tax is the same over the long run and is simply added on top of whatever the market price is at the time. Carbon tax vs carbon trading two sides of the same coin.

If a litre of gasoline costs 095 one day and 105 the next. A carbon tax that would replace regulations andor corporate income taxes would fail to satisfy the environmental activist classs appetite for. Lawmakers could increase federal revenues and encourage reductions in emissions of carbon dioxide CO 2 by establishing a carbon tax which would either tax those emissions directly or tax fuels that release CO 2 when they are burned fossil fuels such as coal oil and natural gas.

It aims to create a level playing field between imports and domestic. The price of carbon dioxide emissions can be adjusted. The carbon tax is the most equitable method for carbon use to pay for its pollution.

List of the Disadvantages of a Carbon Tax. A carbon tax is one way to put a price on emissions. They cost lower income families more to implement on their own.

Higher potential quality of bike frame and other large objectscomponents. A Carbon tax is a specific tax on the consumption of goods which cause carbon dioxide emissions. As Camila Thorndike the dynamic young leader of an effort to get a carbon price passed in Oregon told the Democrats at their platform hearings As a cross-sector and market-based solution a carbon tax empowers business to profitably transition to the clean-energy economy.

Price control over carbon tax. A carbon border tax is a tax on carbon emissions imposed on imported goods from countries with less strict climate policies. A carbon tax puts a monetary price on the real costs imposed on our economy our communities and our planet by greenhouse gas.

Pressure for a faster energy transition process increases. Up to 24 cash back List of Advantages of Carbon Tax 1. One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets.

Determining the Tax Rate That Best Balances the Benefits and Costs of a Carbon Tax 17 The Timing of Action 18 About This Document 20 Figure 1. A number of disadvantages of carbon taxes are. With the carbon tax causing increases in business overheads companies will be prompted to find more efficient ways to manufacture their products or deliver their services as it would be beneficial to their bottom line.

The market price is P1 but this ignores the external cost of pollution. Emissions of CO 2 and other greenhouse gases accumulate in the. In households with low income the use of high emissions like heating homes and driving in public transportation often accounts for greater percent of the households income than in households with higher incomes.

It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage. Higher RD spending for renewable energies.

The Benefits and Drawbacks of Carbon Offsets. Weve Got You Covered. The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes.

Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. C02 emissions have been identified as a major source of global warming and therefore governments have been keen to reduce carbon emissions. Effects of a Carbon Tax on Labor Investment and Output 7.

Companies have an incentive to go green as well. Carbon Tax - The size of a tax on the carbon content of fuels gives a level of certainty to what the final price will be. A carbon tax and cap-and-trade are opposite sides of the same coin.

The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere. A third benefit the reduction of carbon dioxide in the atmosphere is also possible with this structure. People will adjust their consumption behavior.

A carbon tax sets the price of carbon dioxide. A carbon tax is a charge placed on greenhouse gas pollution mainly from burning fossil fuels. More jobs better educational opportunities a stronger infrastructure and more availability for public goods are all possible when the benefits of a carbon tax start working together.

That may sound a little wonky but she added that she and many. Also assess the advantages and disadvantages that India is likely to face with the imposition of this tax. Advantages of Carbon Taxes.

Ad Carbon Tax Credits for Corporations Non-Profits and More. Unlike traditional fossil fuels solar power is accessible to nearly everyone and can be an excellent source of green energy. Products may become more expensive.

In pursuit of reducing greenhouse gas emissions various countries have adopted the practice of carbon trading while others like South Africa have implemented a carbon tax as a corrective means to make carbon-intensive industries more environmentally conscious. Going solar is a great way to help the environment while also reducing your carbon footprint. It encourages people to find alternative resources.

Carbon tax that would replace existing regulations andor taxes is not politically viable. The voluntary carbon offset credit market has the potential to play a major role in allowing society to continue to emit greenhouse gases while striving to keep global warming under 15 degrees. Tax Credits for Non-Profit Companies Corporations and More.

Extremely difficult if not virtually impossible to judge or predict its nature high quality or mediocre or low quality from its outside appearance. Carbon Tax Cons. May hurt poor people.

Higher carbon emissions higher taxes. Many companies cant reduce their emissions as much as theyd like to. Notwithstanding the introduction of the carbon tax and Environment Compensation Charge many commentators believe that India has a long way to go in terms of coal and petroleum pricing structures which have to move in tandem with developments in the countrys.

Lower potential quality of products especially smaller objects. Advantages of the Carbon Tax. Carbon offsetting has benefits at both ends of the process.

Advantages And Disadvantages Of Plastic Important Pros And Cons On Plastic A Plus Topper

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

Carbon Tax Advantages And Disadvantages Economics Help

Advantages And Disadvantages Of Python Python Language Advantages Disadvantages And Its Applications A Plus Toppe Language Easy Learning Memory Management

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Pros And Cons Economics Help

What Are The Pros And Cons Of Banning Plastic Bags Recycling Facts Plastic Free Life Plastic Bag

Advantages And Disadvantages Of Python Python Language Advantages Disadvantages And Its Applications A Plus Toppe In 2022 Easy Learning Memory Management Language

Advantages And Disadvantages Of Carbon Tax Benefits

Regressive Tax Definition Advantages Disadvantages

Incentive Plan Template Beautiful Employee Bonus Plan Template Uk Templates Resume Incentives For Employees Incentive Programs How To Plan

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Advantages And Disadvantages Of A Limited Company Public Limited Company Limited Company Accounting Basics

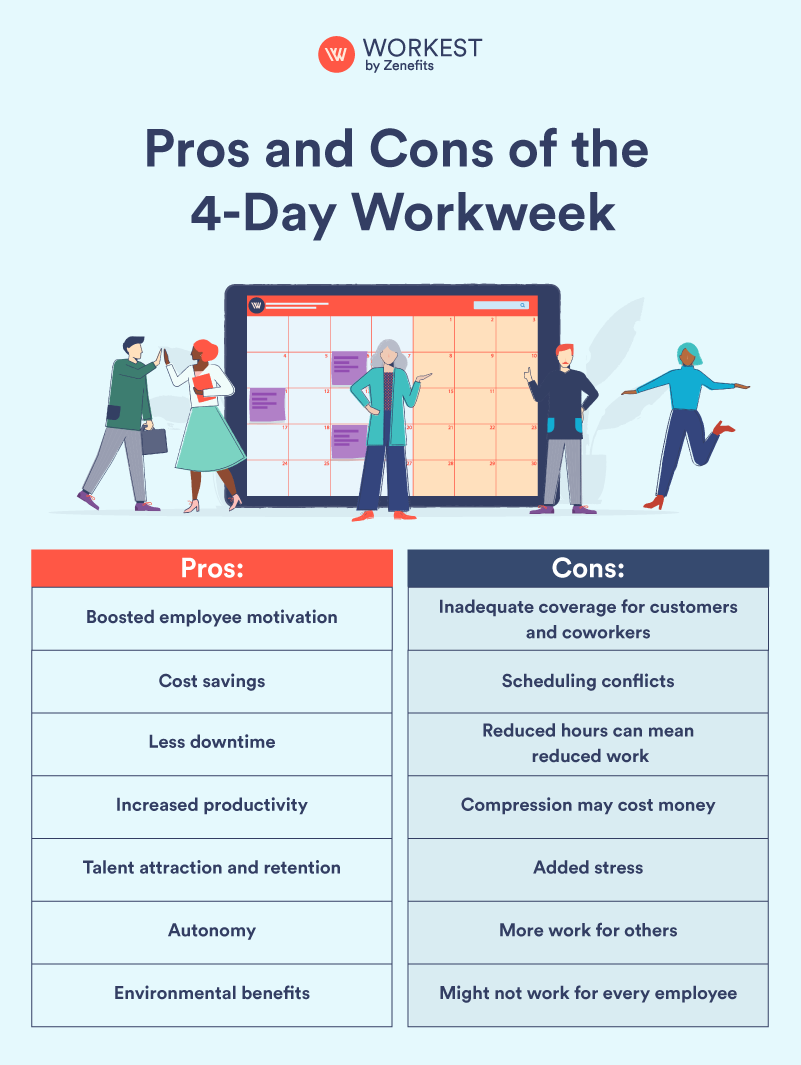

The 4 Day Workweek Pros And Cons Workest

28 Crucial Pros Cons Of Carbon Offsetting E C

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Organization Finance Saving

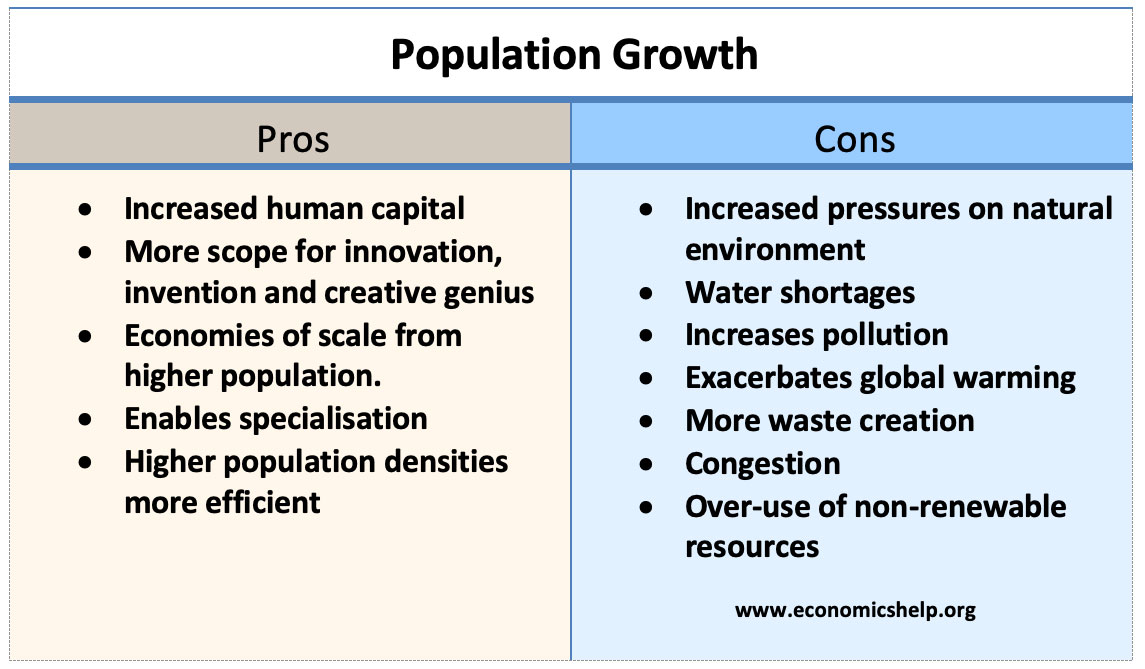

Advantages And Disadvantages Of Population Growth Economics Help